Down on Disparity

Markets frown on large pay gap between CEO and median worker

Who cares if a company’s CEO makes hundreds of times more money than its rank-and-file workers?

Investors care. Or, at least, many of them. And they don’t like it. That’s according to a new study by Stephan Siegel, the Michael G. Foster Endowed Professor of Finance and Business Economics at the University of Washington Foster School of Business.

Siegel and his co-authors document a significant drop in a firm’s stock price following disclosure of a comparably high ratio between the pay of its chief executive officer and its median worker. They also find evidence that investors with more progressive social attitudes tend to shift their portfolios away from firms with large pay disparities.

“Importantly, we find a significantly negative reaction to high pay ratios even when controlling for the amounts of CEO and median worker pay,” says Siegel. “Financial markets react to the disparity independently of whether they think a CEO makes too much or a worker too little.”

New information

Debate over income inequality has intensified as the gap has widened between stagnating middle-class wages and soaring top executive compensation packages from the 1980s through the expansion following the Financial Crisis.

Public firms have been required to report the income of top executives for many years, generally as a sum of salary, bonus, stock options and stock granted. But the disparity between a firm’s CEO and rank-and-file workers has been more difficult to pin down.

This changed recently. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 imposed a number of new financial regulations on publicly traded firms. One of those requirements—to disclose the pay ratio between CEO and median worker—took effect for the first time in 2018.

Siegel and his co-authors—Yihui Pan of the University of Utah, Elena Pikulina of the University of British Columbia and Tracy Yue Wang of the University of Minnesota—wanted to know what market reaction, if any, would follow the disclosure of these pay disparities.

Range of ratios

The 2,300 firms bound by the new regulation began reporting the gap between CEO and median worker salary in their 2018 proxy statement for fiscal year 2017.

The researchers calculated an average CEO-to-worker pay ratio of 145:1 during this period. In other words, the average firm’s CEO earned 145 times what his median employee made.

There was considerable variation, however, from firm to firm. Among the top 25 companies by market capitalization, Walmart’s reported pay disparity was 1,188:1, Johnson & Johnson’s was 452:1, AT&T’s was 366:1, Boeing’s was 166:1, Exxon Mobil’s was 108:1 and Facebook’s was 37:1.

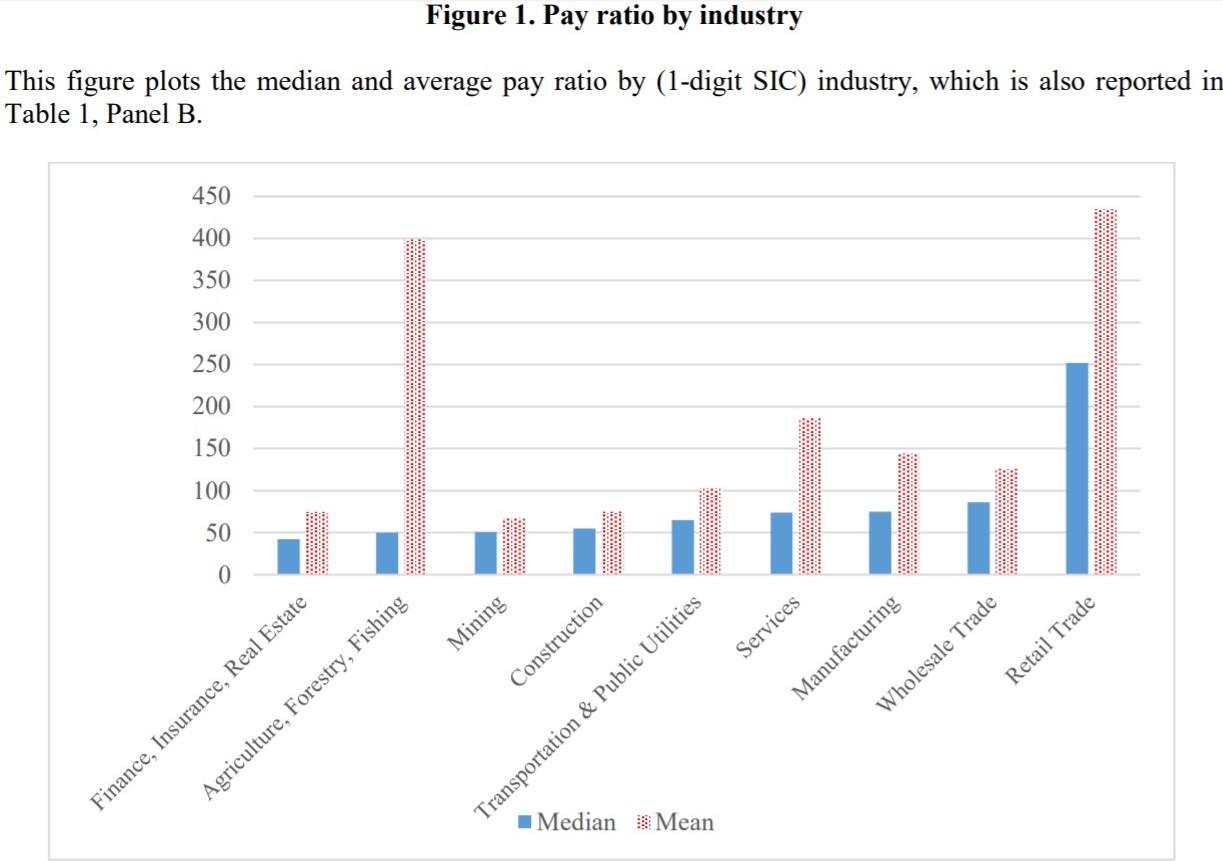

Siegel also determined that around 22 percent of this variation between firms is due to differences across industries. So, for instance, companies in retail and agriculture tend to have much higher pay disparities than those in finance, insurance and construction.

Immediate reaction

Having documented this new data, Siegel and his colleagues calculated market reaction in two ways.

They first measured “abnormal returns”—controlling for the overall market and other factors—on the days immediately following the disclosure of each firm’s pay ratio. The market’s response to larger-than-average pay disparities was significantly negative. How significant? One standard deviation higher pay ratio reduced the abnormal return by almost half a percentage point. The higher the disparity, the lower the abnormal return.

Though he detected no significant investor reaction to CEO pay (high or low), Siegel did observe a positive response to firms reporting higher-than-average median worker pay, independent of the response to pay ratio. “This finding is consistent with the market inferring good news about firms’ fundamentals from high levels of worker pay,” he says.

These levels were eye-popping at some companies. Topping the list for 2017, median workers earned $168,000 at Microsoft, $197,000 at Alphabet (the Google parent), and $240,000 at Facebook.

Shifting portfolios

A second measure captured a longer-term reaction to pay disparity.

Controlling for investor and firm fixed effects, Siegel and his colleagues determined that investors with more progressive social attitudes tended to rebalance their portfolios away from firms with high pay ratios during the remainder of 2018.

They reached this insight by observing changes in the allocations of small institutional investors that likely represent clients in their geographic area. Using an index of state-by-state political preferences as a proxy, they inferred that firms trading on behalf of investors who live in socially progressive states (such as Washington) unloaded more shares in firms reporting high pay disparity than investors in less progressive states (such as Georgia).

Reasons why

Siegel says that the reduction in firm value after a higher pay disparity is made public could be the result of concern over stakeholder action: fear that disapproving customers, employees and governments will apply social pressure or enact policy to reduce pay disparity.

Or it could be that enough shareholders care enough about income inequality that they are willing to divest holdings in firms they believe are promoting it.

Siegel believes this is the most likely explanation, which points to the growing influence of socially responsible investing.

Whatever the reason, he says there already have been instances of firms changing their behavior after the reporting of pay disparities and median worker earnings. For instance, Amazon, a trillion-dollar company, introduced a $15 minimum wage shortly after disclosing that its median worker was making just $28,450 per year (a reflection of thousands of low-income jobs at Amazon distribution facilities).

Of course, there are other ways around this threat to firm value than raising rank-and-file wages or cutting CEO compensation. One obvious way to alter any perceived disparity would be simply to outsource the bottom 10 percent of the payroll, effectively tightening a firm’s reported pay ratio.

“While negative market reactions of 0.5-1 percent for high pay-ratio firms are not gigantic numbers, they are big enough that a CEO and board of directors might pay attention. They might even be big enough to look at how much it would cost to pay people a bit more, or to pay the CEO a bit less,” he says. “At the boundary, it creates an incentive to think about pay disparity a little more.”

“Equity Market Reaction to Pay Dispersion and Shareholders’ Prosocial Preferences” is the work of Stephan Siegel, Yihui Pan, Elena Pikulina and Tracy Yue Wang.